So, if your house didn’t sell, don’t stress. You’re not stuck. You may just need a different professional with a different approach.

So, if your house didn’t sell, don’t stress. You’re not stuck. You may just need a different professional with a different approach.That 2% increase might not sound like a big jump, but in a market where buyer demand has been cooling for the past few years, it’s a sign things are starting to shift. More people are feeling ready (or at least closer to ready) to take the leap and buy a home in 2026.

And if you’re in that camp and buying a home is on your goal sheet this year, this is your nudge to connect with a local agent and a trusted lender to start laying the groundwork now.

If you’re eager to get the ball rolling right away, here’s what to tackle first:

Even if buying feels like a late-2026 goal, this moment still matters. The buyers who feel the most confident later are usually the ones who quietly prepared earlier.

That doesn’t mean big financial commitments or major lifestyle changes. It just means setting yourself up so you’re ready when the timing is right. Here are a few low-stress ways to do that:

Bottom Line

If buying a home in 2026 is on your radar, let’s start the conversation today. Not to rush a decision, but to make sure you know how to get ready for your moment.

Because every move (whether it’s next year or later) is smoother when it starts with a plan. And if you need help coming up with one that works, let’s connect.

When your house doesn’t sell, it does more than disrupt your plans, it hits close to home. You prepared for the next chapter. You told people you were moving. You pictured where you’d go next. And then nothing happened.

It’s normal to feel frustrated, confused, or even a little embarrassed. But here’s the part you have to remember: just because your house didn’t sell the first time, doesn’t mean it won’t sell.

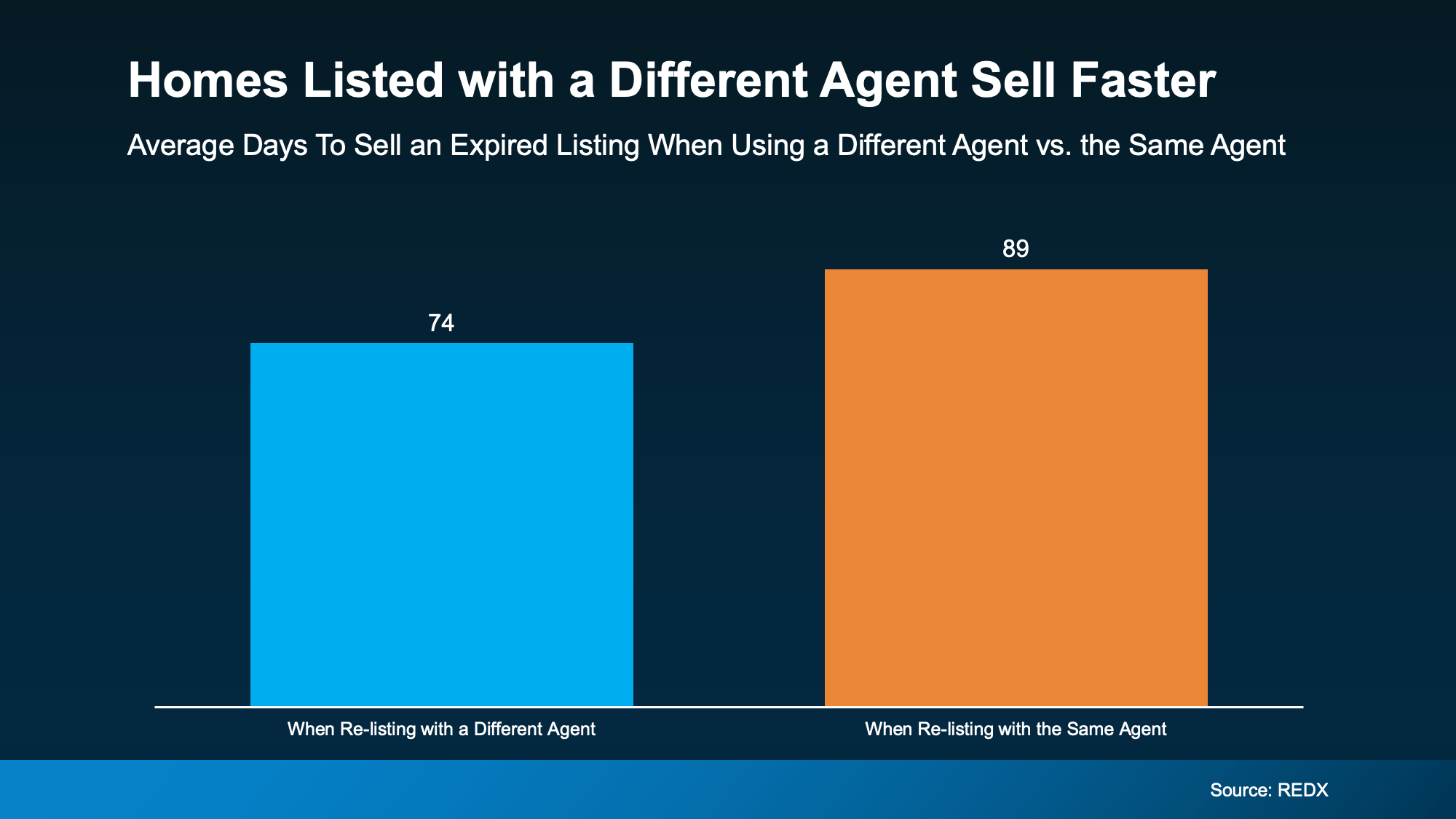

And here’s what most agents won’t tell you. In most cases, the difference typically comes down to the strategy behind the sale, not the house itself. And there’s real data to back that up.

Research from REDX found over half (54%) of homeowners who re-list with a different agent end up selling their house. Re-list with the same agent? That stat drops to only 36%. You deserve better odds than that.

So, if your house didn’t sell, don’t stress. You’re not stuck. You may just need a different professional with a different approach.

So, if your house didn’t sell, don’t stress. You’re not stuck. You may just need a different professional with a different approach.

Because, at the end of the day, maybe the problem wasn’t the market or your home. It was the strategy.

Let’s break down what might’ve gone wrong – and how a fresh perspective can help you have a winning plan this time.

A lot of sellers are aiming a bit too high these days, hoping to match the price their neighbor got during the 2021 frenzy. And that’s not working anymore.

Today’s buyers are being more selective. Even a slightly overpriced home will get overlooked today. And once your listing starts to go stale, it’s hard to regain momentum. The result? A widening gap between seller and buyer expectations (see graph below). That could be what cost you your sale.

The Fix: Get a fresh pricing analysis rooted in what’s happening right now in your neighborhood – not what happened in 2021. Sometimes even a small adjustment can bring the right buyers through the door. HousingWire reports many successful sellers only had to reduce their price by about 4% to get real traction. In the grand scheme of selling a home, it’s really not that much.

The Fix: Get a fresh pricing analysis rooted in what’s happening right now in your neighborhood – not what happened in 2021. Sometimes even a small adjustment can bring the right buyers through the door. HousingWire reports many successful sellers only had to reduce their price by about 4% to get real traction. In the grand scheme of selling a home, it’s really not that much.

You only get one shot at a first impression. If the listing photos didn’t pop, the house wasn’t staged well, or it wasn’t updated, most buyers today will skip over it without ever scheduling a showing. And even if buyers did pass through, small things like scuffed walls, outdated light fixtures, or a wobbly doorknob can turn them away.

The Fix: Let’s walk through your house with fresh eyes to see if there are any areas that may have been sticking points inside and out. Sometimes simple updates (new paint, updated lighting, fresh landscaping, or better listing photos) can completely change how buyers react.

If your home didn’t sell, chances are it wasn’t getting the visibility it deserved. Generic flyers and a few online photos aren’t enough anymore. Today’s top agents are using highly targeted digital marketing, social media strategies, custom video content, and more to get your listing in front of the right buyers at the right time.

The Fix: We have to do more than just put your house online and hope it sells. With the right pricing, staging, and marketing, your house can still sell. It may even happen faster if you switch agents. Here’s a real-world example (see graph below):

4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To NegotiateIn this market, flexibility matters. If you weren’t open to negotiating on repairs, closing costs, or other concessions, buyers may have walked, especially because many now expect at least some give-and-take.

The Fix: Be willing to meet buyers where they are. The goal is to get the deal done – and sometimes that means getting creative to cross the finish line. Home values have increased by 48.5% over the last five years, so you likely have enough wiggle room to offer some perks without sacrificing your bottom line.

If your house didn’t sell and your listing has expired, you’re not stuck. You just need a better plan. And maybe, a better partner.

Same house. Different strategy. Completely different results.

If you’re ready to understand what held your sale back (and how to get it right this time), let’s take a fresh look together. A few strategic shifts could be all it takes to get your move back on track.

Now may be a better time to sell than you’d expect.

Since mortgage rates have come down compared to their high earlier this year, more buyers are re-starting their home search. And here’s the data to prove it.

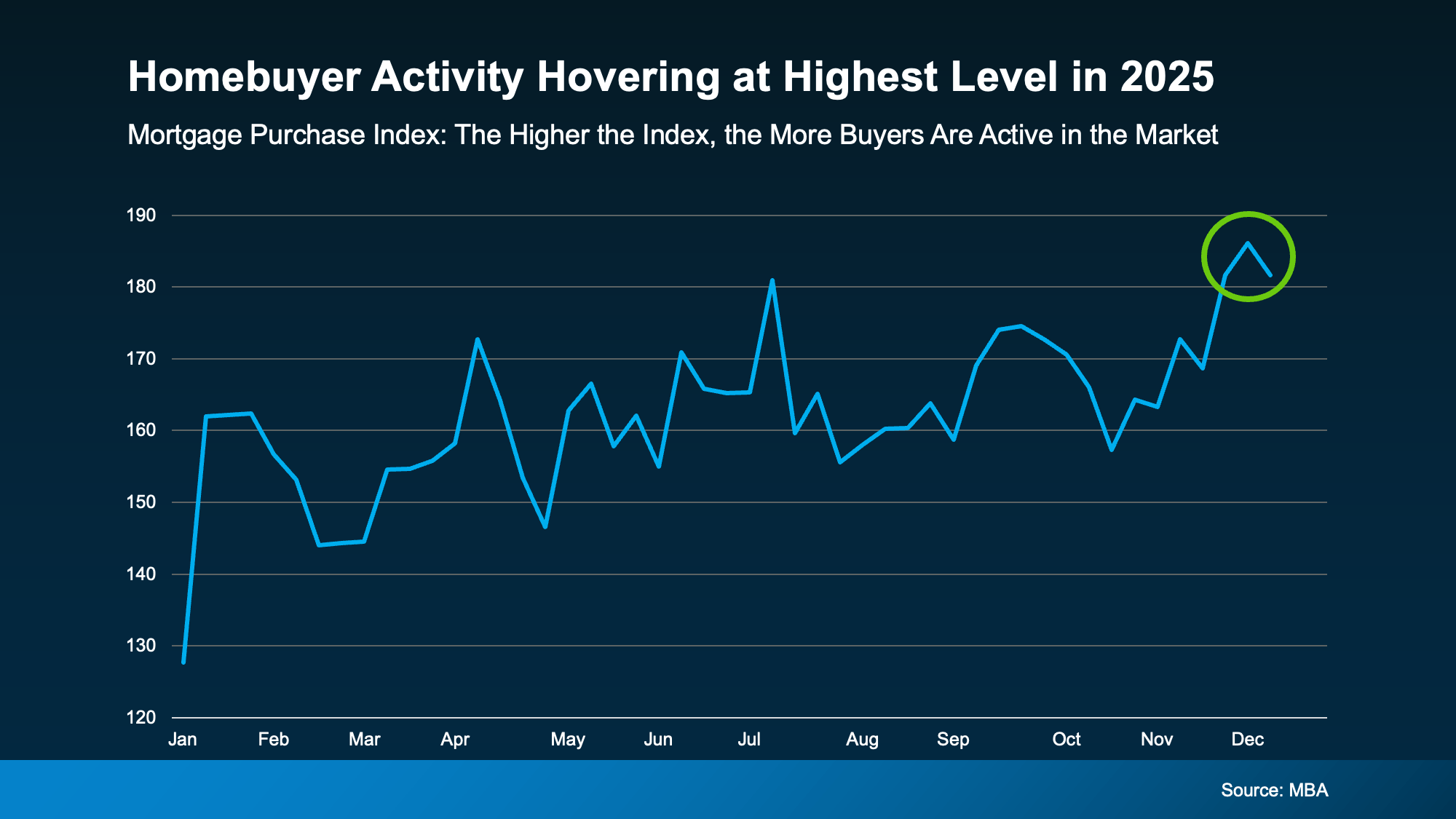

This graph shows homebuyer activity is hovering at the highest level so far this year.

More people are applying for home loans. And it’s already turning into more homes going under contract.

That jump in activity opens up real opportunities for sellers right now.

There’s a renewed sense of energy in the market going into 2026. And homeowners who decide to sell can ride that shift in momentum.

If you want to get in on the action and get your house in front of these eager buyers, let connect and start the process.

The housing market hasn’t felt this energized in a long time – and the numbers backing that up are hard to ignore. Mortgage rates have eased almost a full percentage point this year, and that shift is starting to wake up buyers.

Home loan applications have risen. Activity has picked up. And sellers who step in early could benefit from the momentum long before the competition catches on.

Let’s take a look at what’s happening behind the scenes and how you can take advantage of it.

In today’s market, buyer demand is closely tied to what happens with mortgage rates. As rates come down, applications for home loans go up. Rick Sharga, Founder and CEO of the CJ Patrick Company, explains it like this:

“We’re in an incredibly rate-sensitive environment today, and every time we’ve seen mortgage rates drop into the low-to-mid 6% range, we’ve seen an influx of buyers hit the market.”

And that’s exactly what the data shows. More people who were sidelined are applying for mortgages again now that borrowing costs have come down. Of course, that’s going to ebb and flow just like rates ebb and flow. But the bigger picture is, there’s been improvement as a whole since rates started coming down.

In fact, the Mortgage Bankers Association (MBA) shows the Mortgage Purchase Index is hovering at the highest level so far this year:

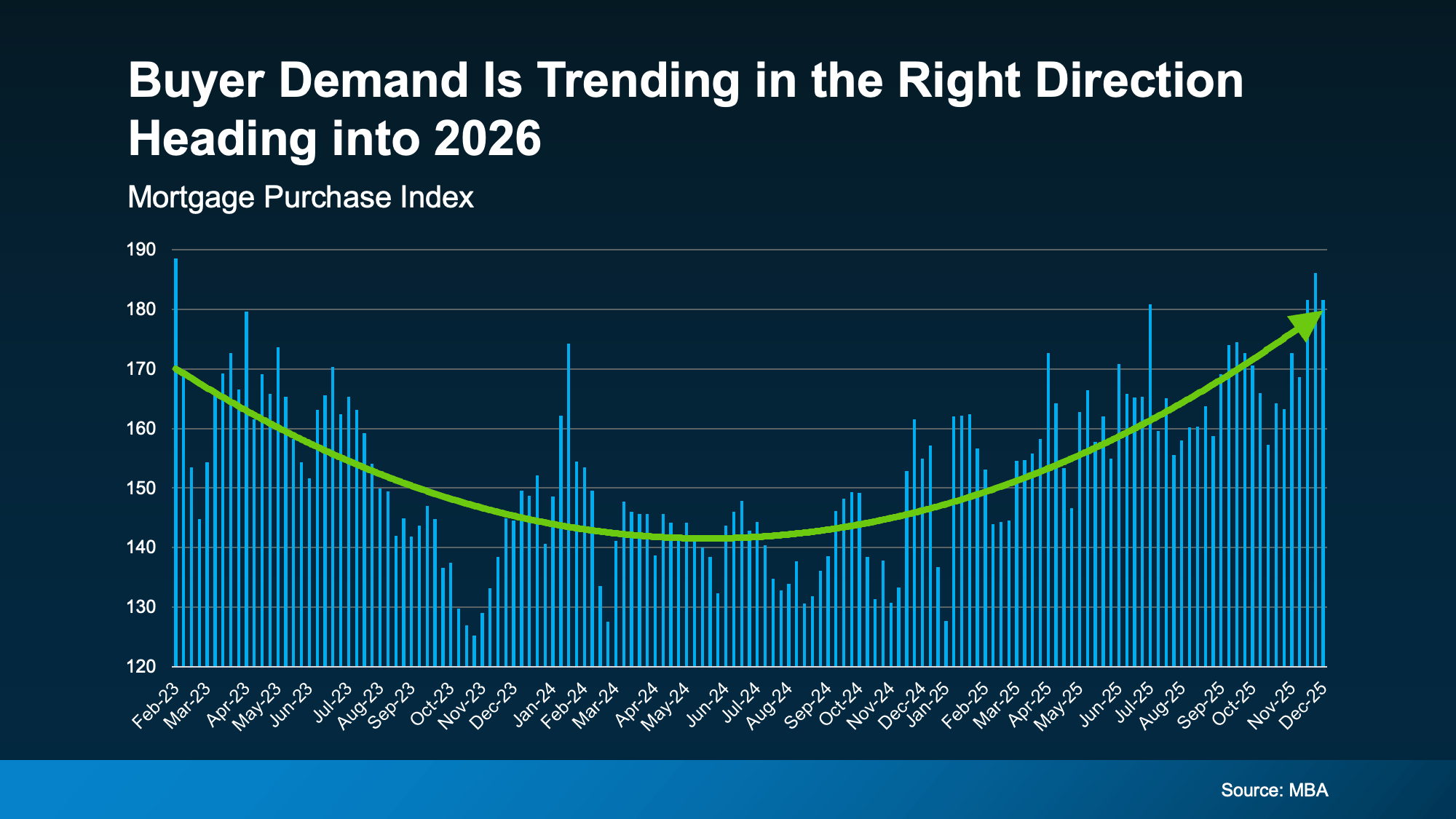

And that’s not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

And that’s not the only sign of optimism. MBA also shows mortgage applications recently hit their highest point in almost 3 years too. A clear sign demand is moving in the right direction heading into 2026:

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

And just in case you were wondering, it’s not just pent-up demand coming out of the government shutdown that slowed some of the processing of government loans for a month or so. If you look back at the last graph, you’ll see the steady build-up of momentum throughout the entire year.

The big takeaway for you is this. Now that rates have come down, buyers are starting to ease back into the game. And that’s turning into real contracts on homes just like yours.

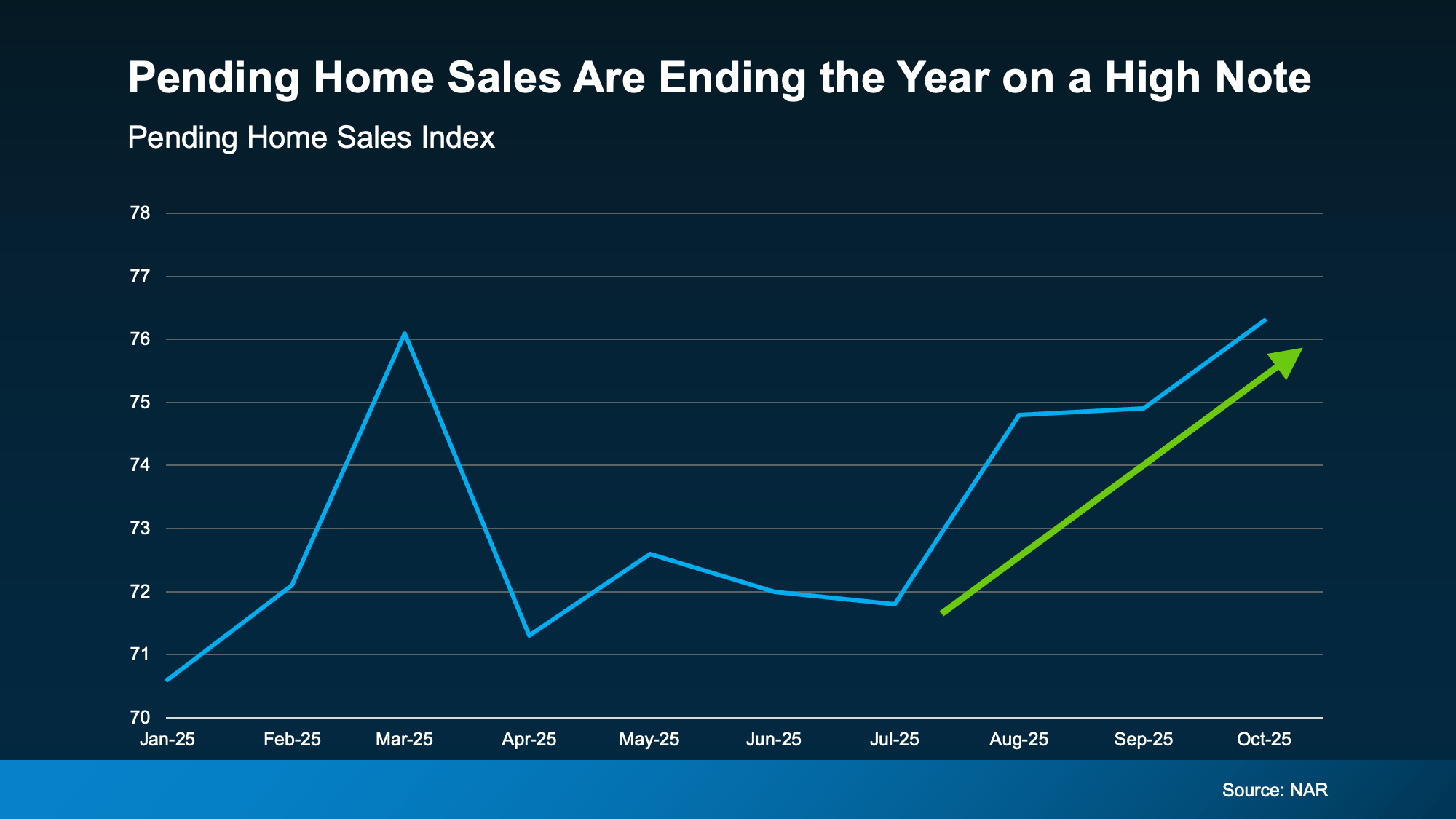

Just to really drive home that this is trending in a good direction, the most recent report from the National Association of Realtors (NAR) shows pending home sales (homes that are under contract) are picking up too. The Pending Home Sales Index is also at the highest it’s been all year (see graph below):

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

Pending home sales are a leading indicator of where actual sales are going. If more homes are going under contract, it’s a good sign more homes will actually close over the next two months, ultimately boosting sales. This could be part of why experts project home sales will inch higher in 2026 than they were in 2025 or in 2024.

Of course, this may ebb and flow a bit as we see some year-end volatility with mortgage rates. But, it shouldn’t be enough to change this overall trend. Expert forecasts say rates should stay pretty much where they are throughout 2026. That means the stage is set for this momentum to continue going into the new year.

Here’s the opportunity. Selling now means:

Whether you’ve been putting off selling because you thought buyers weren’t buying, or you took your house off the market because you weren’t getting any bites, this is your sign to act.

Want to know what’s happening with buyer activity in our area, and what it could mean if you want to sell your house in the new year?

Let’s talk about getting your house listed in early 2026, so you can take advantage of this momentum building in the market.

A lot of people are asking the same thing right now: “Is it even a good time to sell?” And the truth may come as a bit of a surprise…

For many homeowners, the answer is a strong yes.

Why? Because of one major factor working in your favor: your equity. Odds are, if you’ve lived in your home for a while, you know you have significant equity. But how much are we really talking about? The number might just change everything about your next move.

Here’s how it works. When you own a home, you build up something called equity.

Each time you make a mortgage payment, you’re chipping away at your loan balance. And that helps your ownership stake in your home grow. At the same time, home values typically rise – which drives up the overall value of your home.

When you put those two things together, you’re building wealth automatically, month after month, year after year.

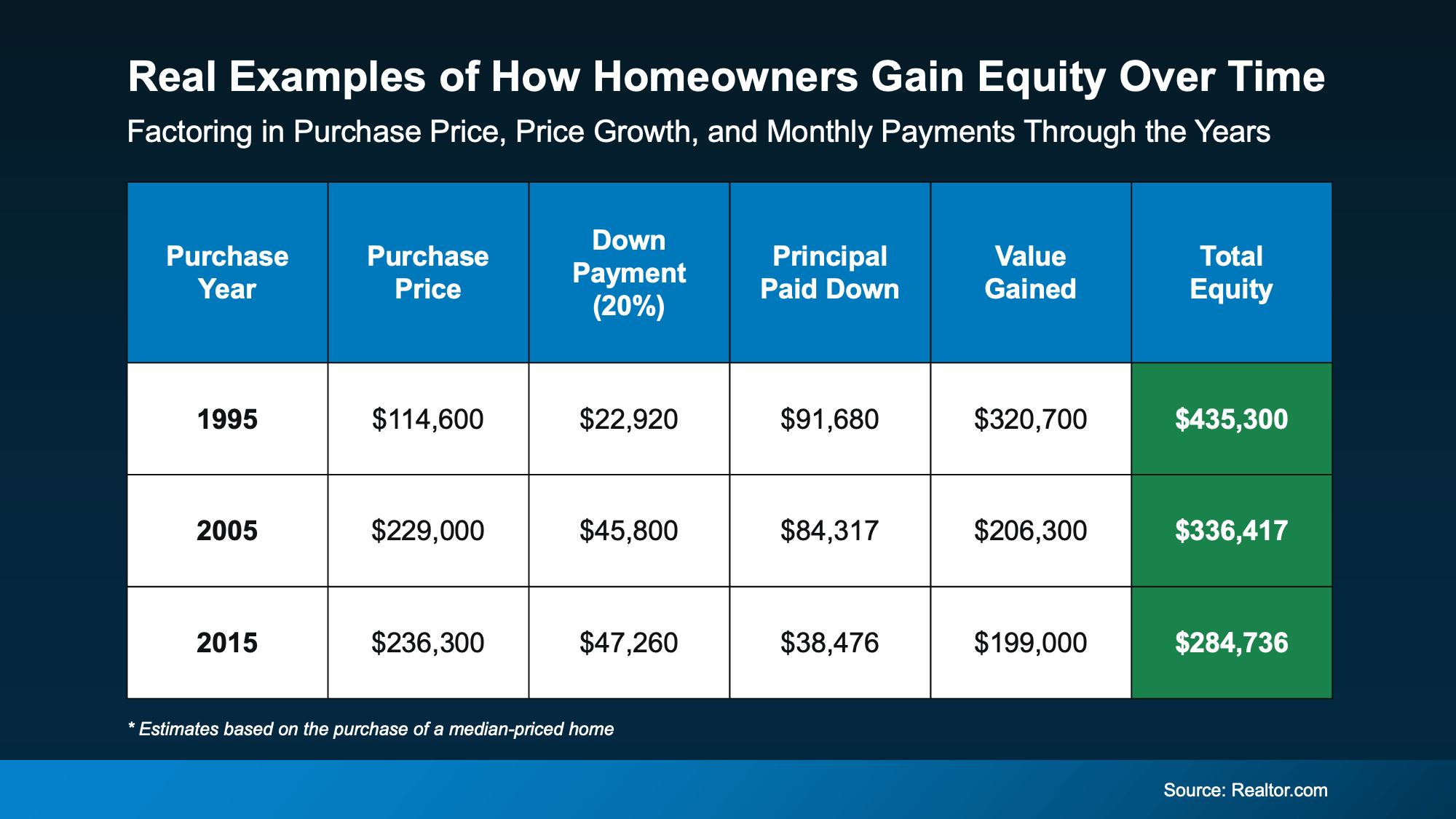

And that combo can add up to real dollars that can make a real difference in your move. That’s especially true if you’ve lived in your house for a while, which many homeowners have. According to Realtor.com:

“Nearly half (45.2%) of today’s homeowners have lived in their home for more than 15 years, and 1 in 4 for over 25 years.”

If that’s you, just imagine what 15-25 years of payments + steady appreciation have done to your bottom line. It’s time you see how your equity stacks up over time.

This chart uses research coming out of Realtor.com to show an estimate of how much equity homeowners have built up depending on when they bought. For each time frame, it takes the median-priced home and uses it as the baseline example. The numbers are shocking, too. According to the study, if you bought the average-priced home in…

Of course, your actual number is going to vary based on the purchase price, any work you’ve done to the house, the size of your original down payment, and more. The point is…

Of course, your actual number is going to vary based on the purchase price, any work you’ve done to the house, the size of your original down payment, and more. The point is…

A lot of homeowners are sitting on hundreds of thousands of dollars in equity without even realizing it.

Here’s where this becomes really important. That equity can offset nearly every concern you have about moving right now.

If you haven’t had someone help you understand the value of your home this year, now’s the perfect time to take another look. It doesn’t mean you have to sell. But it does mean you’ll at least know what you could be working with – and how far that number can take you.

If you want a custom professional equity assessment, let’s connect.

Spring gets all the attention, but it’s not always the best time to sell a house. Yes, more buyers show up, but so do a lot of other sellers.

Winter is different. With fewer homes on the market, your house has a much better chance of standing out. And that one advantage can make a big difference.

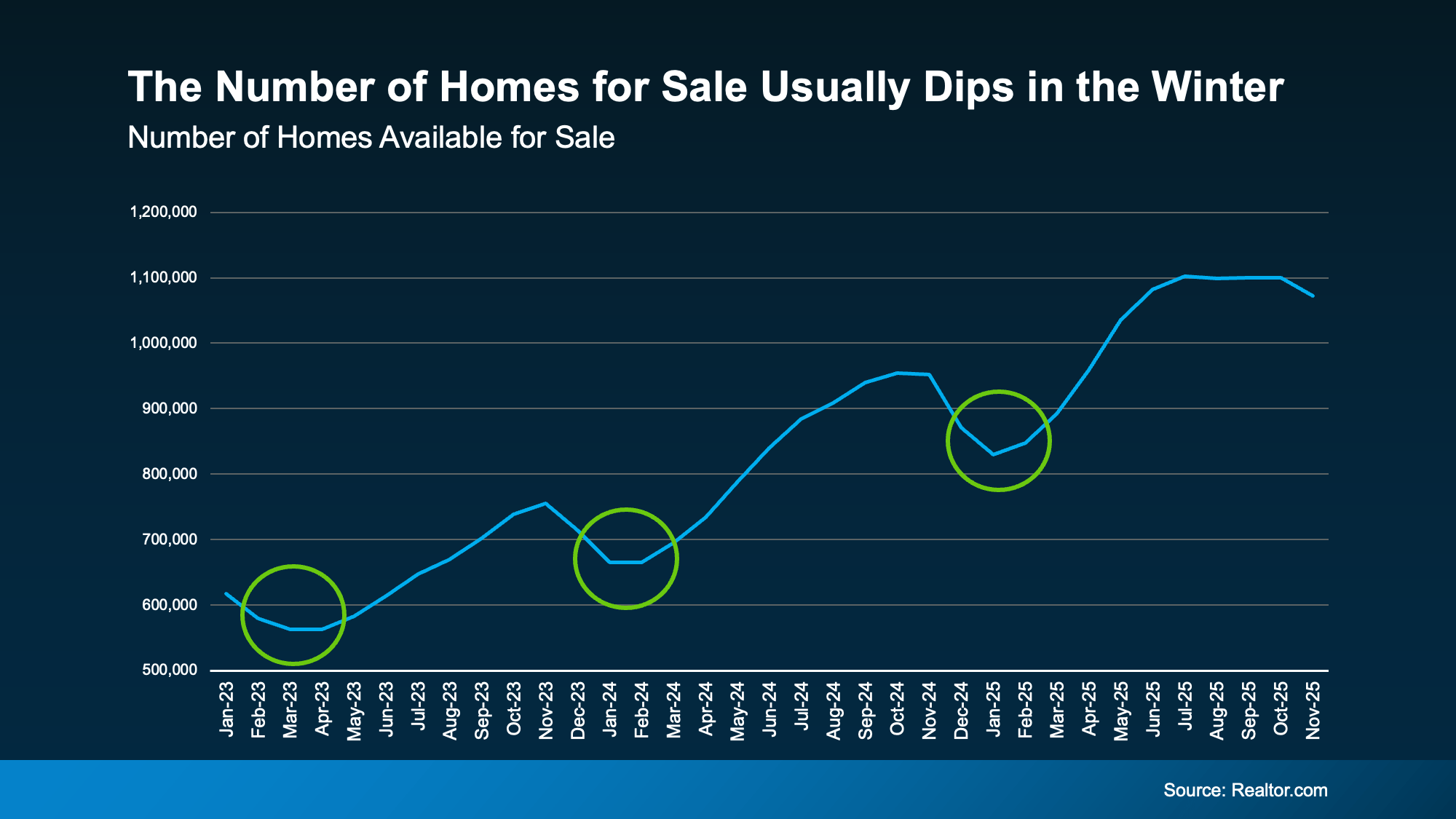

History shows the number of homes for sale tends to drop during the winter months. It’s a trend that’s predictable almost every year.

Data from Realtor.com shows this pattern clearly. Inventory dips in the winter (the green circles in the graph below), then climbs again as soon as spring approaches:

And based on the latest data available, it looks like that pattern may be true again in 2025. The graph shows the supply of homes for sale is starting to come down as we head into the end of the year. And if history is any indicator of where it goes next, it’ll continue to fall just like it usually does.

And based on the latest data available, it looks like that pattern may be true again in 2025. The graph shows the supply of homes for sale is starting to come down as we head into the end of the year. And if history is any indicator of where it goes next, it’ll continue to fall just like it usually does.

Here’s why knowing this gives you an edge.

While inventory is higher now than it’s been in the last few years, there are still not as many homes for sale as there’d be in a normal market (2017-2019). And we may even be poised for inventory to dip a bit as the weather cools.

That gives you an opportunity. If you work with an agent to list now, you’ll sell while other homeowners are taking their homes off the market and before the number of homes for sale climbs this spring.

Less competition from other sellers now = more attention on your house this season.

Why wait until everyone else lists in the spring when you can get ahead of the crowd?

Another big perk is the buyers looking right now usually need to move.

They’re not just browsing for fun. They’re relocating for work, dealing with a lease ending, making a big life change, or simply ready to move forward sooner rather than later. As U.S. News explains:

“. . . buyers who are trudging through wintry weather often have a good reason for being out in the cold – they need to move. Whether it’s a relocation for a new job, a divorce or the arrival of a new baby, buyers who brave the elements are usually serious and able to make quick decisions.”

That means fewer weekend wanderers and more highly motivated, qualified buyers walking through your door.

And since we know inventory usually drops this time of year, odds are they’ll have a little less to choose from compared to the fall. If you price and prep your house right, maybe your house will be the one that catches their eye.

Winter might not get the same buzz as spring, but that’s exactly why it works in your favor. Less competition from other sellers, more motivated buyers, and a chance for your house to truly stand out.

If you’re thinking about selling, this season can give you a real advantage. Let’s connect and talk through what listing now could look like for you.

Understanding the Difference Between Interest Rate and APR

One of the least understood aspects of obtaining a home loan is the difference between the interest rate and the APR (Annual PercentageRate). At first glance, they sound like the same thing, but while they both impact the cost of the loan, they are two different aspects of the home loan program.

Home interest rates, or more commonly referred to as mortgage rates, are the actual cost of borrowing the money needed to buy the home. Lenders use the borrower’s credit score, income, loan amount, and other factors to determine their risk of lending the money. Then, they determine how much interest to charge on the principal loan amount.

On the other hand, APR provides an overall picture of the total cost of borrowing. It includes not only the interest rate cost, but also other costs and fees associated with the loan. Items such as origination fees, points, and mortgage insurance are all added to the total interest due over the course of the loan and then compared to the amount borrowed to determine the Annual Percentage Rate.

For potential borrowers, the APR allows them to compare the total cost of the loan among all available loans. One might offer a lower interest rate but once the fees and costs are included, it may end up costing more in the long run.

Mortgage financing can seem complicated and confusing but by learning the terms and how they affect the loan, borrowers can make informed decisions about what loan program makes sense for their needs.

A lot of buyers are stuck in “wait and see” mode right now. They’re watching rates hover a little above 6% and thinking, I’ll buy once they hit the 5s. Because who doesn’t want a better rate?

But here’s the thing: that 5.99% number might not save you as much as you think.

Affordability is still a challenge. There’s no question about that. But the market has given savvy buyers a head start. Mortgage rates have already come down over the past few months. And the drop we’ve seen saves you more than you’d think.

Let’s put some real numbers to it. Rates peaked for the year in May when they inched above 7%. But since then, they’ve been slowly declining. Now, they’re sitting in the low 6s. And while that may not sound like a big deal, that change translates to real dollars.

According to data coming out of Redfin, the typical monthly payment on a $400,000 home is already down almost $400 since May.

That means if you’re buying a home now, you’re saving hundreds of dollars every month compared to what you would have been able to get earlier this spring. That’s real money that makes a real difference for buyers who paused their plans because they thought homeownership was out of reach.

And while it may be tempting to wait even longer to see bigger savings, that’s a gamble that could cost you. Here’s why.

For starters, most experts say mortgage rates are likely to stay pretty much where we are today throughout 2026. So, there’s no guarantee we’ll see a rate much lower than what we have now. Only one expert forecaster is saying rates could fall into the upper 5s next year (see graph below):

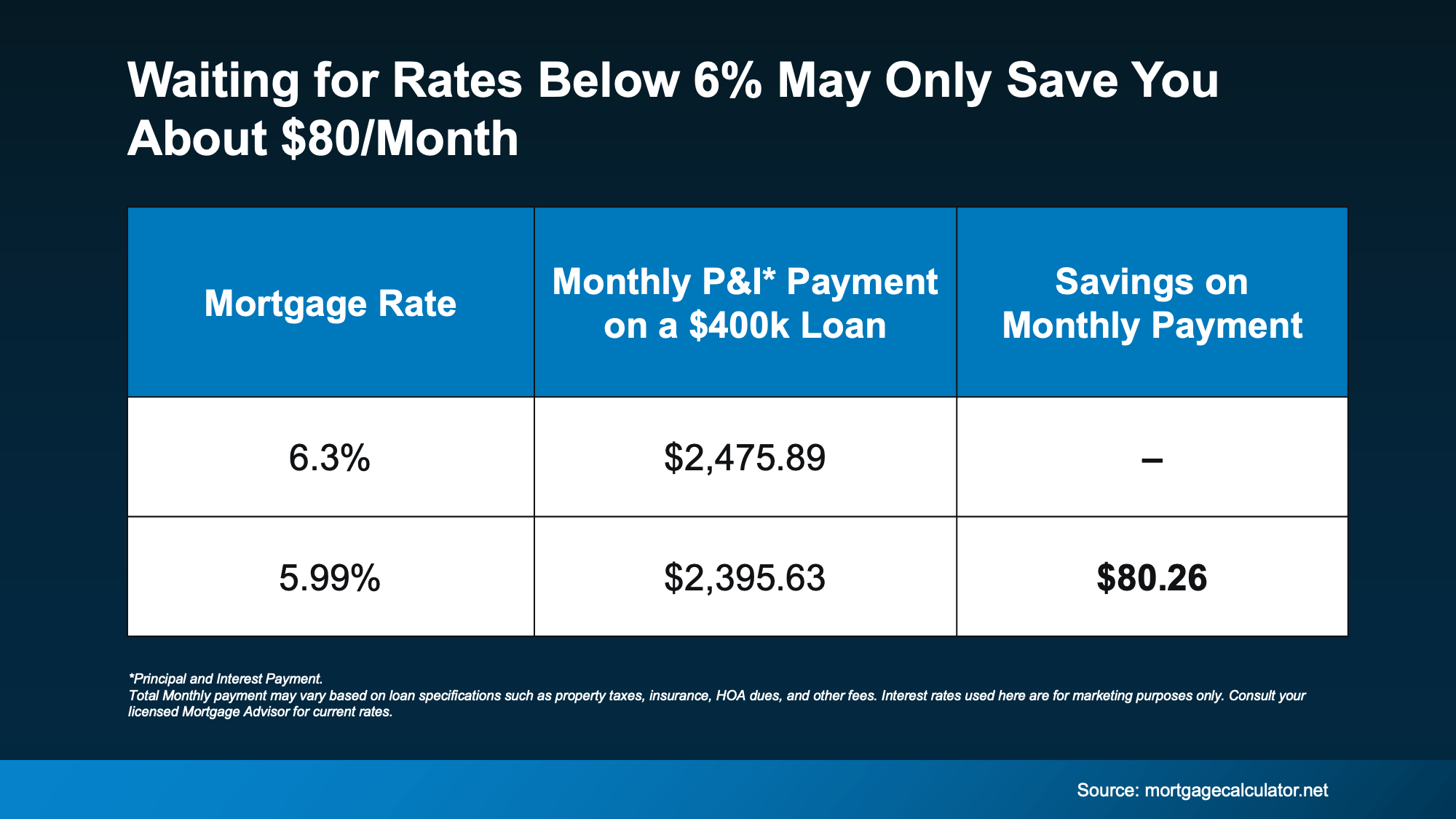

And even if rates do dip below 6%, the extra savings you’re holding out for won’t move the needle as much as you might expect.

And even if rates do dip below 6%, the extra savings you’re holding out for won’t move the needle as much as you might expect.

Let’s break it down. If rates come down to 5.99% from where they’ve been lately that’s a difference of only about $80 a month on an average priced home – give or take a bit based on your price point and the rate your lender quotes you (see chart below):

Eighty dollars. That’s it. And for the typical family, that’s about one dinner out (or one dinner in, if you have it delivered). That’s not enough to change the game for most buyers. But the savings of nearly $400 we already have compared to when you paused your search in the spring? That might be.

Eighty dollars. That’s it. And for the typical family, that’s about one dinner out (or one dinner in, if you have it delivered). That’s not enough to change the game for most buyers. But the savings of nearly $400 we already have compared to when you paused your search in the spring? That might be.

So, the question to ask yourself is this:

Is an extra $80 savings really worth the wait?

Because while you’re holding out for that small dip, the bigger opportunity might be slipping away.

Right now, you have more homes to choose from, sellers who are ready to negotiate to get a deal done, and fewer buyers to compete with. But once rates fall below 6%, buyer mindsets will shift and all of that will change.

The National Association of Realtors (NAR) reports that if rates hit 6%, about 5.5 million more households will be able to afford the median-priced home. Even if only a small fraction of them decide to buy, that could mean hundreds of thousands of buyers getting back into the market.

That creates more competition for you, which would push home prices even higher – maybe high enough to cancel out the extra savings you waited for.

So, if you’re waiting for rates below 6%, just keep in mind… that extra $80 may not be worth it in the grand scheme of things.

You don’t have to wait for 5.99%. You have the chance to move (and save) right now. So, ask yourself: Would you let $80 hold you back from buying a home?

If you find a home you love and the math makes sense, getting ahead may be the best strategy. Let’s run your numbers so you can see what you’re working with in our market.

Mortgage rates have been the monster under the bed for a while. Every time they tick up, people flinch and say, “Maybe I’ll wait.” But here’s the twist. Waiting for that perfect 5-point-something rate could end up haunting your wallet later.

According to the National Association of Realtors (NAR):

“. . . a 30-year fixed rate mortgage of 6% would make the median-priced home affordable for about 5.5 million more households—including 1.6 million renters. If rates were to hit that magic number, it’s likely that about 10%—or 550,000—of those additional households would buy a home over the next 12 or 18 months.”

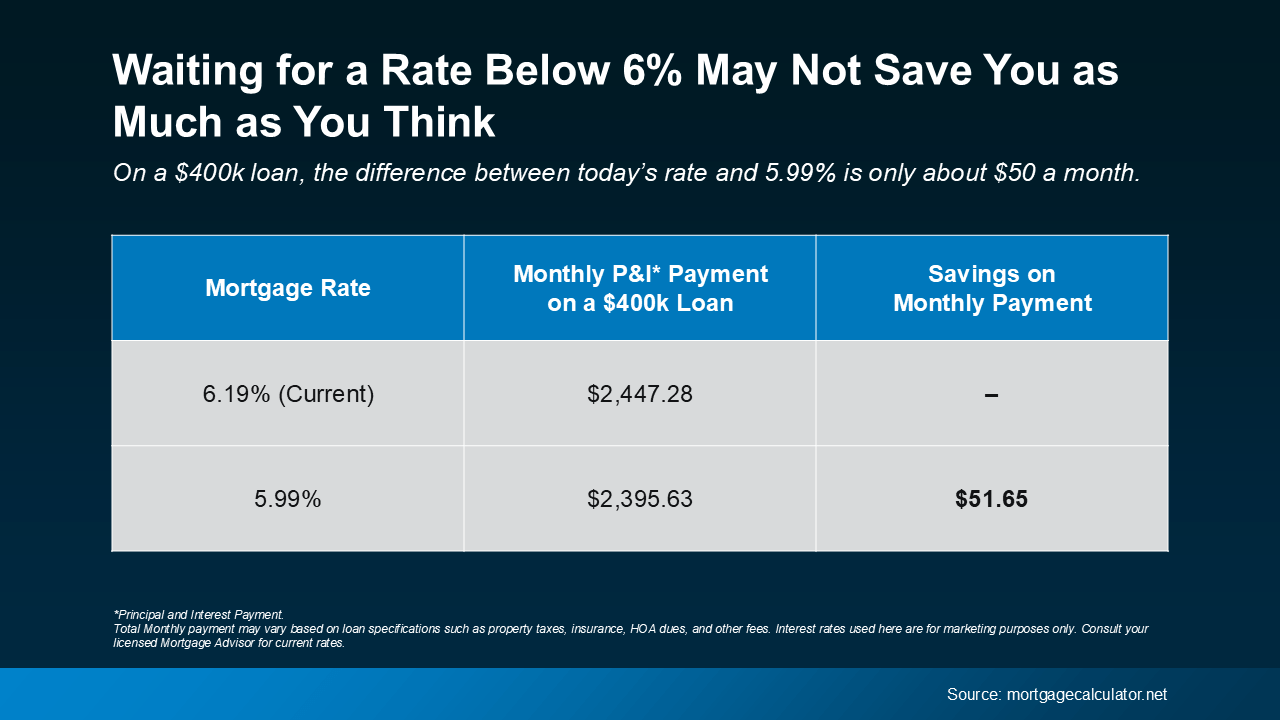

When the market hits that mortgage rate sweet spot, as expert forecasters are starting to say is more likely in 2026, the psychological shift to lower rates will kick in for more of today’s hopeful buyers. That will unleash some pent-up demand that’s been waiting on the sidelines, and the increase in activity will cause prices to rise.

And while a 5.99% rate might sound like a big win, if you’re waiting for that number to make your move, it might not actually save you as much as you think. Here’s how the math looks when you run the numbers (see chart below):

On a $400,000 mortgage, the difference between today’s rate (around 6.2%) and 5.99% is roughly $50 a month. That’s less than many people spend on weekly coffee runs or occasional DoorDash orders. And as prices tick up with more buyers in the market, that could quickly negate any of your potential savings.

On a $400,000 mortgage, the difference between today’s rate (around 6.2%) and 5.99% is roughly $50 a month. That’s less than many people spend on weekly coffee runs or occasional DoorDash orders. And as prices tick up with more buyers in the market, that could quickly negate any of your potential savings.

So, if you’re waiting for 5.99%, that difference might not be worth missing out on today’s opportunities, like having more homes to choose from, better negotiation leverage with today’s sellers, and fewer buyers out there looking for the same houses.

Because the reality is, those benefits start to slip away when more buyers begin to make their moves – and a rate under 6% is exactly they’re waiting for.

Jessica Lautz, Deputy Chief Economist and VP of Research at NAR, says:

“Over the last 5 weeks, mortgage rates have averaged 6.31%. This has provided savvy buyers a sweet spot to reexamine the home search process with more inventory, widening their choices.”

And like Matt Vernon, Head of Retail Lending at Bank of America, notes:

“Rather than waiting it out for a rate that they like better, hopeful homebuyers should assess their personal financial situation—if the house is right for them, and the upfront and monthly payments are affordable, it could be the right chance to make a move.”

If moving at today’s rate scares you, remember, waiting doesn’t always pay off. Once rates dip below 6%, as some experts project they’ll do next year, more buyers (and higher prices) will be back.

So, don’t be afraid of today’s mortgage rates. Because if you’re ready, this might just be your chance to make your move before the market wakes up again.

Mortgage rates, home prices, and inventory are shifting in ways that make this one of the most interesting housing moments in years. Here’s what the data — and the experts — are saying, plus what it means if you’re thinking about buying in the Milwaukee, Waukesha, or Brookfield areas.

As of October 11, 2025, the average 30-year fixed-rate conventional mortgage is 6.125 % (source: Freddie Mac Primary Mortgage Market Survey).

That’s down from highs above 7 % earlier this year and roughly in line with Redfin’s October 6 report, which showed the daily average at 6.38 %.

This softening follows the Federal Reserve’s recent rate cut and weaker national job data, both of which eased borrowing costs and nudged more buyers back into the market.

According to the Wisconsin Realtors Association, listings statewide rose ~ 5 % YoY and months of supply up ~ 8 % as of June 2025 (WRA Report).

That still makes it a low-supply environment, but slightly more balanced than last year — a modest win for buyers seeking negotiation leverage.

Reasons to Consider Buying Now

Reasons to Consider Buying Now Reasons to Be Cautious or Wait

Reasons to Be Cautious or WaitRedfin Chief Economist Daryl Fairweather notes,

“Nationally, now is a good time to buy if you can afford it. Prices keep climbing, but with falling mortgage rates and more inventory, buyers have an upper hand in negotiations.” (Redfin, Oct 6 2025)

For Metro Milwaukee buyers, the market is showing signs of balance without major downside risk.

If you’re financially ready and plan to own for the long term, today’s rates and inventory levels create a real opportunity.

If you’re still organizing your finances or seeking specific neighborhood conditions, waiting a few months could add clarity — but don’t expect dramatic price drops.

Contact us at LaFleur Realty Group if you’re uncertain and we’ll walk you through the numbers, consider your interests, and help you decide whether “now” is the best time for your move.

414-573-3300

scott.lafleur@kw.com

LaFleurRealtyGroup.com